The market has undoubtedly changed since the interest rates started climbing in the 2nd quarter of 2022. However, real estate inventory for sale is still very low so in that respect, we remain in a “Seller’s Market.” Most lake homes and residential homes under $500,000 still receive multiple offers in many cases, not having to reduce their prices. We just had five offers on our recent $1.5M Winona Lake listing in Warsaw, and sold for $100K over asking. Within 24 hours of being listed, I recently took a buyer to see a home on Sylvan Lake listed at $479,000, and they had multiple offers, including ours. Unfortunately, our clients were outbid. In the $400Ks and below in regular residential, we still have an average day on the market of 18 days which is historically very low and very good for sellers.

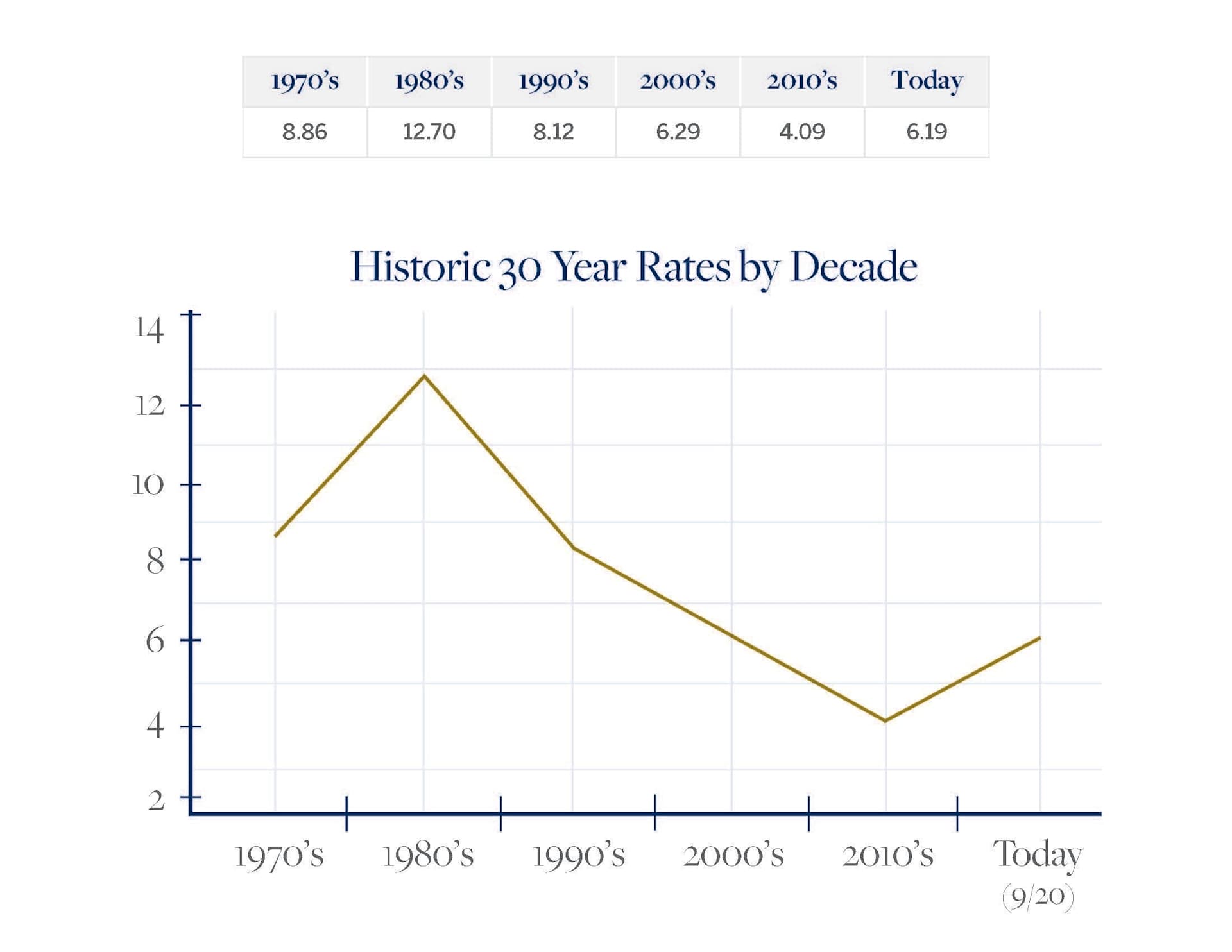

When you get to over $500,000, the average days on the market is much slower at 30 days but not terrible. For example, we just sold another firm’s listing that had to reduce its asking price from $849,900 to $760,000 to sell to our client near that 30-day window. We have not seen price reductions like that in a long time, since pre-Covid. Days on the market are ticking up on the higher end. I suspect most of our high-end buyers will be transfers to town coming in for new jobs in the 4th quarter unless they are cash buyers due to climbing interest rates. But we need to look at these interest rates today compared to historical data. When you see these historical rates, our current 6% could be a lot worse and has been.

If we can advise you on potentially selling or buying in this changing market, just contact us for a consultation.

*Data sourced from Freddie Mac